Import and Export Regime

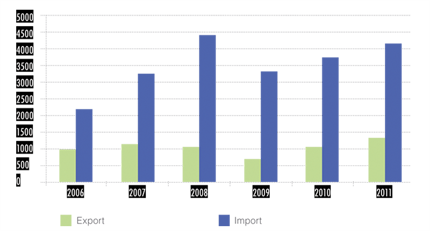

Armenia’s foreign trade policy aims to attract foreign direct investments and liberalize trade regimes. As a member of the World Trade Organization since 2003, Armenia has worked to reduce customs burdens and reform the existing customs system. Examples include an on-line customs declaration system (e-declaration); a traffc light system for inspection of goods entering Armenia; and a reduction in the number of import documents from nine to three. Today Armenia offers a liberal trade and investment regime. The average applied tariff, at 2.7%, is among the lowest of WTO Members. As the WTO member Armenia benefts from Most Favored Nation (MFN) treatment and has an MFN regime in place with all WTO member countries. In its turn it grants MFN and National Treatment regimes to foreign investors, which are present in almost every economic sector.Armenia’s customs policy is administered by the State Revenue Committee. Customs regimes and procedures are defned by the Customs Code of the Republic of Armenia and other legal acts, which comply with rules defed by WTO agreements and other international treaties.Armenia is a member of the World Customs Organization (WCO) and applies the Harmonized System for tariff classifcation, in compliance with the 1984 International Convention on Harmonized Commodity Description and Coding System. Only two tariff rates apply on imports of goods to Armenia: 0% or 10%. The 0% tariff applies to imports of capital goods, and the 10% tariff to imports of consumer products. All imports are subject to the payment of a VAT of 20% and alcoholic beverages, tobacco products, and fuels are also subject to an excise tax.There are no tariff quotas, licensing requirements or quantitative restrictions on imports. Nor does Armenia maintain a system of minimum import prices.Armenia does not tax exports and does not have any licensing requirements for exporting. There are neither export duties nor VAT payment obligations or limitations.The volume of foreign trade in Armenia in 2011 was 2,044.2 billion AMD or $5,481.0 million USD, of which exports were 495.8 billion AMD or $1,329.5 million USD, and imports were 1,548.4 billion AMD or $4,151.5 million USD (See table 3 and fgure 10).

IMPORT REGLATIONS

Armenian legislation requires all goods and vehicles imported through the border of Armenia to be subject to declaration in the Regional Customs House where the importing organization or sole proprietor operates, with the exception of Yerevan Zvartnots Customs House, TIR Customs House and the Automobile Customs Point.

There are nine customs houses (fve regional and four specialized) and six customs points. Seven of these work around-the-clock:

- Zvartnots customs-house,

- Meghri customs point,

- Bavra customs point,

- Shirak airport customs-house,

- Bagratashen customs point,

- Ajrum-Jilizia customs point, and

- Gogavan-Privolnoye customs point.

Customs clearance is not obligatory at the border, but may be carried out by the importer or by a licensed customs broker.

Table 3. The volume of export and import to Armenia per year (million USD)

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|---|

| Export | 985,1 | 1152,3 | 1057,2 | 710,2 | 1041,1 | 1329,5 |

| Import | 2191,6 | 3267,8 | 4426,1 | 3321,1 | 3748,9 | 4151,5 |

Source: NSS

Figure 10. Export and Import of Armenia per year

All goods imported commercially must be declared to customs within ten days after arrival in the Armenian customs territory, and they remain under customs control during this period (although not necessarily under physical control). Though not yet compulsory, the on-line customs declaration system (e-declaration) will replace many functions previously done on paper, such as management of custom cards and production of customs declarations. This greatly reduces the time required for completion of customs procedures. The electronic card system combines a number of functions related to customs payments, so any necessary procedures can be carried out from an offce computer. The release of customs declarations for which payment was made electronically is sent through TWM system. The upgraded electronic system includes a traffc light (channel) system at the border. Goods passing through the green channel cross the border without any verifcation. If the red channel is selected, the import is subject to documentary verifcation and physical examination. For the yellow channel, only documentary verifcation is necessary.According to studies by the World Bank, it took on average only two days to complete the customs clearance procedure in 2011. Only three documents needed be presented at customs clearance.After the reforms were implemented, the Customs Code introduced post-clearance controls, through which the State Revenue Committee may review customs declarations submitted during the last three years.While most imports are free of prohibitions, quotas or licensing requirements, there are restrictions for health, security or environmental reasons. These restrictions include requiring authorization for pharmaceutical products and medicines, phytoprotection chemicals, weapons, components used in the production of weapons, explosives, nuclear materials, poison, drugs, strong psychotropic substances, devices for use in opium smoking, and pornographic materials. The transit through Armenian territory of any nuclear material, nuclear-related equipment or substances emitting ionizing radiation is prohibited.The import of medicines must be authorized by the Ministry of Health, and the import of agricultural chemicals by the Ministry of Agriculture.There are compulsory health, hygiene, and consumer rights standards for a range of foodstuffs, electrical goods, alcoholic and non-alcoholic beverages, tobacco products, and children’s clothes, among other imports.The Republic of Armenia’s customs legislation contains the following compulsory customs payments levied by the customs bodies:

1. CUSTOMS DUTIES

The customs duty rates are provided by article 102 of the Republic of Armenia Customs Code. Customs duty rates for imported goods are 0% and 10%.

2. CUSTOMS PAYMENT

Besides tariffs, imports are subject to: a customs formalities fee of 3,500 AMD ($9 USD), a customs inspection and recording fee of 1,000 AMD ($3 USD) for each cargo weighing less than one ton, and 300 AMD ($1 USD) for each additional ton of cargo.When customs formalities and/or inspections are carried out elsewhere than in places determined by the Customs Authorities or during non-working days, the customs fees are doubled. Importers also have to pay 1,000 AMD ($3 USD) for each document (form) provided by the Customs Authorities.In addition, importers may incur other customs user fees depending on the services supplied by Customs, such as accompaniment of transit shipment and warehousing services.

3. VALUE ADDED TAX

A 20% VAT is levied on all economic activities, including the importation of goods and services, with the exception of those subject to simplifed taxation (i.e. companies with taxable turnover of less than 58.4 million AMD or $146,000 US) in a calendar year). The taxable base is the customs value of the goods, plus the amount of any import duties and excise tax levied at the time of importation (if any). VAT must be paid within ten days of importation.

4. EXCISE TAX

Excise tax is an indirect tax levied on domestically-produced and imported alcoholic beverages, tobacco products, petrol, and diesel fuels. The tax rate varies according to the product (for more information on customs fees please visit www.customs.am).

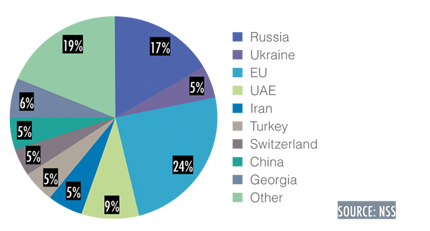

The European Union is the biggest exporter to Armenia. According to 2011 figures, EU countries account for 24% of total imports by Armenia, followed by Russia (17%) and UAE (9%) (See figure 11).

Major imports include mining products, petroleum, oil products, natural gas, machinery and equipment.

EXPORT REGULATIONS

According to the Customs Code of Armenia, all goods exported from Armenia are subject to customs declarations. Goods must be declared at the regional customs offce closest to the exporter's location, with the exception of goods exported via Yerevan International Airport, which must be declared at the airport customs offce. Goods and vehicles with TIR Carnets exported by legal persons are declared in the TIR Customs House in Yerevan. There are no registration requirements for exporters, and all exports of goods from Armenia are subject to a simple customs declaration system. A declaration form is submitted to the customs offcial, who is responsible for verifying its completeness as well as the validity of the supporting documentation.

There are no export restrictions and export taxes in Armenia, and there is no system of minimum export prices. Exported goods and ancillary services are zero rated for VAT purposes.

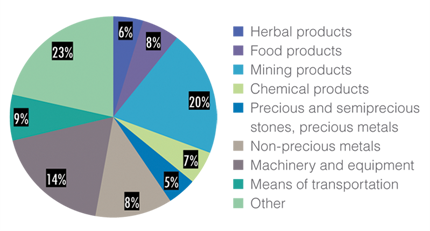

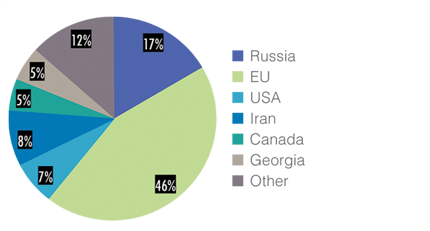

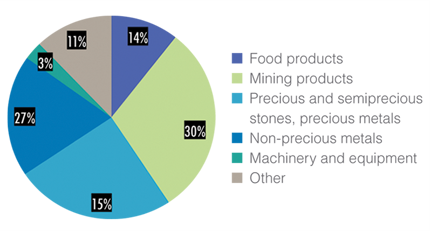

As is the case for most imports, the vast majority of export products are free of any prohibitions or quotas. The export restrictions that do exist are imposed for health, security, and environmental reasons. Armenia has no export licensing regime; however for some products exporters need to obtain prior State permission for export operations. These are weapons, nuclear materials, pharmaceuticals, rare animals and plants, rare objects or artifacts considered part of the national patrimony. Armenia applies only those trade embargoes imposed by United Nations Security Council Resolutions.Export of dual-use goods is regulated by the law “On Controlling Export of Dual-Use Commodities Items, their Transit through the territory of the Republic of Armenia as well as Transfer of Dual-Use Information and Products of Intellectual Activity”. The export of controlled items is done via permission granted by the Ministry of Economy.According to the World Bank's Doing Business Report 2012, in Armenia it takes one day to complete export customs clearance procedures. Only three documents are required. The European Union is the biggest partner for Armenian exports. According to 2011 fgures, the EU accounts for 46% of exports from Armenia, followed by Russia (17%) and the United States (8%) (See fgure 13).Major export items include mining products, precious and semiprecious stones, precious metals, non-precious metals, and food products (see fgure 14).

DOCUMENTATION

The list of documents necessary for customs control:1. For goods and transport facilities imported by organizations and sole proprietor:a) Customs declaration, and in cases specifed in Customs Legislation, CD 1 form of customs value declaration;b) Goods acquisition invoice or contract, or the document proving the request for payment via Internet, or other corresponding substitute document; and c) The document establishing the goods’ transport arrangement (goods-transport consignment note).2. For goods and transport facilities exported by organizations and sole proprietor:a) Customs declaration;b) The invoice or the contract of acquisition, or other corresponding substitute document; andc) The document establishing the goods’ transport arrangement (goods-transport consignment note).3. For goods and transport facilities imported and received in person:a) Customs declaration, and in cases specifed in Customs Legislation, CD 1 form of customs value declaration; andb) Goods acquisition invoice or contract, or the document proving the request for payment via Internet, or other corresponding substitute document.4. For goods and transport facilities exported and sent in person:a) Customs declaration in the cases specifed in Customs Legislation.Other documents can be required by legislation while transporting separate goods by customs frontier; in particular, the original documents required for non-tariff regulation purposes – permission, conclusion, license, certifcate, and certifcation while transporting separate goods by customs frontier by organizations, individual entrepreneurs and physical persons.

CUSTOMS REGIMES

The following customs regimes are defned by Legislation for Implementation of Customs Procedures:

• Import for free circulation

• Re-import

• Transit shipment• Import into Customs warehouse

• Import to duty free shop

• Temporary import for processing

• Temporary import

• Temporary export

• Import into free customs warehouse

• Temporary export for processing

• Export for free circulation

• Re-export

• Renunciation of the ownership right to State benefts

• Import into free economic zoneNon-Armenian nationals may be able to bring personal effects into the country tax-free and duty-free under the temporary importation rules, but this may also involve re-exporting the effects within one year. The authorities will also check off items re-exported against effects brought into Armenia.

CUSTOMS VALUATION

Armenia's regulations on customs valuation are in line with the Agreement on Implementation of Article VII of the General Agreement on Tariffs and Trade (GATT) of 1994. The customs value of imported or exported goods is determined by the declarant, or in the absence of required documents by the customs bodies, based on GATT Article VII.The principal method prescribed by the Customs Code of Armenia for the calculation of the customs value of imported goods is based upon the transaction price of the imported goods (the price paid or payable for the goods for export to Armenia). If it is not possible to determine the transaction price of the imported goods, or the customs office has doubts about the data provided by the importer, the following alternate valuation methods will be applied:• Defning customs value by the transaction price of the same goods• Defning customs value by the transaction price of similar goods• Defning customs value of goods transported by the RA customs frontier according to the sale price of the goods in the RA internal market• Defning customs value by the calculation value method• Defning customs value by the reserve method.The Customs Code of Armenia grants the importer the right to demand a written explanation of the valuation decision and the method used by customs authorities, and requires a response within fve working days of submission of the written request. It also gives importers the right to appeal the decision to a superior customs bodies or to the court.

RULES OF ORIGIN

Armenia has introduced a “one-stop shop” process to provide rules of origin certifcates. To receive the certifcate, the proprietor needs to apply to Ekspertiza Limited Liability Company of the Chamber of Commerce and Industry of Armenia. The practice is to apply preferential rules of origin under all free trade agreements that are in force, including those with the following countries: Belarus, Georgia, Kazakhstan, Kyrgyz Republic, Moldova, Russian Federation, Tajikistan, Turkmenistan, and Ukraine.

OTHER PROVISIONS

Imports of plants and plant materials must be accompanied by phytosanitary certifcates from the country of origin. Clearance at the border is only provisional. Imported plant materials must then be taken to an authorized customs clearing site near Yerevan for fnal inspection and sampling before full clearance is given.All imports of animals require veterinary certifcates. This certifcate requires a corresponding certifcate from an offcially recognized veterinarian in the exporting country showing that the animal complies with Armenian requirements for vaccinations and absence of parasites, and comes from an area recognized by the Offce Internationale des Epizooties (OIE) as free of pests and diseases listed in Armenian legislation. Not all imported cargos are subject to sampling and testing.Only 17 products are subject to the Mandatory Conformity Assessment. The list includes fish and fish products, vegetable oils, bread and bakery products, toys, radio equipment, and firearms. Export of the following is prohibited:• Any foreign currency, in cash, exceeding an amount equal to 10,000 USD• Materials containing state secrets• Spirit beverages subject to branding with stamps registered and recognized in Armenia but not bearing such stampsFor more detailed information on Armenian import and export procedures please visit www.customs.am.

Import and Export Regime

Import and Export Regime