Export-Led Industrial Policy

The Armenian economy has traditionally been driven by industrial investment. During the Soviet era, Armenia had one of the best-developed industrial sectors in the USSR. The industrial sector is still considered as one of the most important sectors of the economy, with a 15% share of GDP in 2010. The fastest-growing Armenian industries include mining and metallurgy, food production, pharmacology, cloth manufacturing and jewelry. There is also great potential for information technology, light industry, chemicals, biotechnology, machinery, instrument-making, electrical, and construction materials.

The Armenian economy has traditionally been driven by industrial investment. During the Soviet era, Armenia had one of the best-developed industrial sectors in the USSR. The industrial sector is still considered as one of the most important sectors of the economy, with a 15% share of GDP in 2010. The fastest-growing Armenian industries include mining and metallurgy, food production, pharmacology, cloth manufacturing and jewelry. There is also great potential for information technology, light industry, chemicals, biotechnology, machinery, instrument-making, electrical, and construction materials.

In order to increase economic competitiveness and ensure sustainable economic growth, the Government of Armenia has declared the development of a knowledge-based economy as its core long-term strategic objective; while simultaneously developing a range of sectors with strong export potential. The guiding vision for industrial policy is to position Armenia as a country producing high-value and knowledge-intensive goods and services with creative human capital at its core.

The long-term goal of Export-Led Industrial Policy is to form new ‘export driver’ sectors by expanding not only current export industries but also those with major export potential; as well improving the regulatory framework for doing business, eliminating barriers to trade, modernizing infrastructure, increasing the competitiveness of Armenian products and attracting foreign investment.The policy is principally focused on 11 sectors: wine, brandy, diamond processing, clockware, textiles, biotechnology, pharmaceuticals, canneries, mineral water, juice bottling, and precision engineering. The country’s priority focus for purposes of developing a diversifed export industry will include sectors with the greatest growth potential, established export markets and the largest export volumes in recent years; since these have strong prospects for increasing production volumes signifcantly with moderate additional capital investment. Key industries in this group may include communication technologies, tourism, health, education, and agriculture.

The focus also includes development of sectors that have grown dynamically in recent years but do not exceed USD $10m in export volume, as well as knowledge and technology- intensive sectors. The policy strategy in this area will target larger-scale investments, working to effectively address systemic factor endowment and institutional constraints and to develop manufacturing and export capacity. This strategy is currently being implemented with two priority areas of emphasis:

a. Creating a business environment favorable for increased productivity

b. Providing supporting tools for private sector companies engaged in industrial development.

Reforms aimed at making the country’s business environment one of the most favorable in the region include:

- Greater accountability of government, improving the quality of public services, improving the effciency of tax administration, and comprehensive implementation of risk management-based audit and control systems;

- Simplifying export and import procedures through business process reengineering and automation, as well as improving market quality and service;

- Implementing e-government systems;

- Simplifying procedures for obtaining construction permits;

- Speeding up the judicial process;

- Increasing sustainable access to fnance;

- Streamlining property registration procedures;

- Simplifying bankruptcy procedures;

- Protecting intellectual property and supporting Armenian exporters in foreign markets in protecting intellectual property.

Armenia seeks favorable foreign trade treatment abroad to promote achievement of its industrial policy objectives. As a member of WTO, Armenia benefts from Most Favored Nation status with all other WTO member countries. To enlarge its export capacity, Armenia is in negotiation with the European Union to sign an Association Agreement. The future “Deep and Comprehensive Free Trade Area” will be part of this agreement, which aims at connecting Armenia to the EU both economically and politically. Armenia monitors the performance of free trade agreements signed with the Commonwealth of Independent States (CIS) countries (with the exception of Azerbaijan and Uzbekistan). The keys to a successful industrial policy in Armenia include developing an advanced logistics infrastructure network, in particular along the North-South Road corridor, an international logistics center near “Zvartnots” International Airport, and free economic zones; improving education infrastructure; introducing national quality infrastructure reforms, including reducing the administrative burden on businesses imposed by technical regulations; and eliminating obsolete standards and requirements for compulsory certifcation. Special attention will be paid to consumer protection through the introduction of global best practices and by harmonizing Armenia’s goods safety and consumer protection legislation with that of the EU.Attracting foreign direct investment (FDI) is one of the most important strategies for increasing productivity. In addition to providing capital, FDI serves as an important source of new/innovative technology, as well as new management methods or “knowhow”, and enhanced access to markets. A portfolio of initiatives will be aimed at the important task of attracting leading transnational corporations to come to Armenia to undertake sector-specifc investments. In this regard special importance will be attached to attracting leading technology frms.

Armenia’s new industrial policy is intended to create special investment-friendly tax and customs regimes, provide fnancial support, assure access to fnance and markets, develop institutional capacity, increase competitiveness, and promote market-relevant research and development over the long term. The following key initiatives in these areas are envisaged during the 2012-2015 period:

- Full operation of a risk-based control system in the felds of tax and customs

- Elimination of the requirement to calculate and charge VAT on the border for industrial machinery and equipment

- Operation of FEZs

- Creation of laboratories and certifcation bodies in accordance with internationally-accepted requirements in at least three priority sub-sectors

- Development of relevant regulations for quality management systems, capacity building for supervisory bodies and support for introducing compliance systems in companies within at least three priority sub-sectors

- Attraction of leading multinational corporations to Armenia into priority sectors

- Creation of a robust export fnance institution.

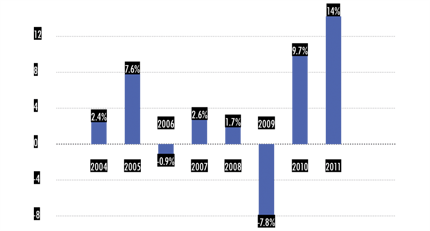

Figure 15. The Growth of Armenia’s Industry

The success of the Government’s reforms on industrial growth was demonstrated in 2011: Industrial production in Armenia in 2011 reached 992.1 billion AMD, a 14% growth over 2010 fgures. Approximately 50% of total production was exported. It is expected that by 2013, the growth performance of the diamond and jewelry, watch manufacturing, light industry, and brandy-making industries will improve signifcantly. It is also expected that new skills and felds will emerge by 2015 in such key industries as pharmaceuticals, biotechnology, canned food, wine, mineral water and juice production.

The main advisory bodies and institutions responsible for the Government of Armenia’s export-oriented industrial strategy are the Industrial Council, the Prime Minister, the Ministry of Economy, the sectoral strategy-making councils, and the Armenian Development Agency.

Export-Led Industrial Policy

Export-Led Industrial Policy